CORPORATE RESPONSIBILITY

WHAT IS RESPONSIBLE INVESTING?

At Hulborngrowth, we define responsible investing (RI) as an investment process that incorporates environmental, social and governance (ESG) factors into its approach. RI enables clients to align their investments with global megatrends that are changing the investment landscape. Issues such as increasing regulation, the growing need for risk mitigation and a heightened social conscience can be more effectively addressed by integrating ESG factors into the investment process.

WHY IS RESPONSIBLE INVESTING IMPORTANT?

ESG can allow firms to foster a meaningful change in the global economy, and in the communities in which we live and work. We believe that ESG analysis leads to more effective investment solutions that address global challenges and create sustainable value for our clients.

The integration of ESG factors is used to enhance traditional financial analysis by identifying potential risks and opportunities beyond technical valuations, providing data on issues such as potential reputational risk or identifying firms which are adapting to meet new market challenges. It is important to note that the main objective of ESG integration remains financial performance.

OUR APPROACH TO RESPONSIBLE INVESTMENT

1. ESG integration

We believe that high-quality companies which manage ESG risks and opportunities well will make attractive long-term investments. Our research team considers ESG factors when evaluating individual companies and when they assess fund managers. Through the use of Sustainalytics, a third-party provider of ESG data, material risks and opportunities are fed into traditional financial analysis and models for our ‘buy list’ stocks.

Our research team address ESG issues in due diligence questionnaires for all funds considered for our buy list. The team also has a dedicated socially responsible investing (SRI) list for funds with a sustainability focus, and with restrictions on investment in harmful activities. The SRI list helps our investment managers select funds which aim to deliver attractive investment returns while contributing positively to global environmental and social challenges.

2. Ethical screening

During suitability discussions with their investment manager, clients can choose to apply certain ethical screening criteria to their portfolio. Clients can select certain restrictions for direct holdings, and portfolios are then created and managed to reflect these restrictions

3. Engagement and stewardship

Brewin Dolphin is committed to being a good steward of our clients’ investments, to enhance and protect their long-term value. We are supporters of the UK Stewardship Code and have a tier one rating for our engagement work.

For each core holding, our research team will monitor and engage with company management on priority material issues that impact the value of our clients’ assets, which include material ESG issues. This can be done directly or via collective engagement with other shareholders.

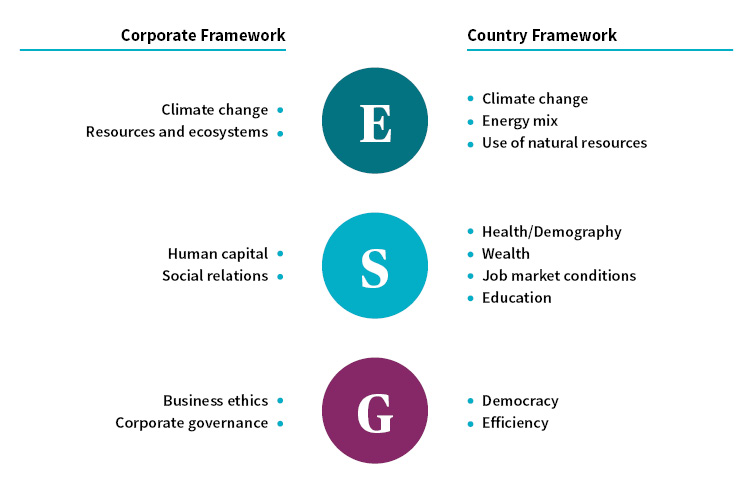

KEY DIMENSIONS OF OUR ESG ASSESSMENT OF CORPORATIONS AND COUNTRIES